Notes: Within the notes section of the invoice, you can stipulate any additional terms of service that you've agreed to with your customer. So please consult your local tax resource to determine how much tax you should be applying to your invoices.

This rate may differ depending on the geographic location you're business operates in.

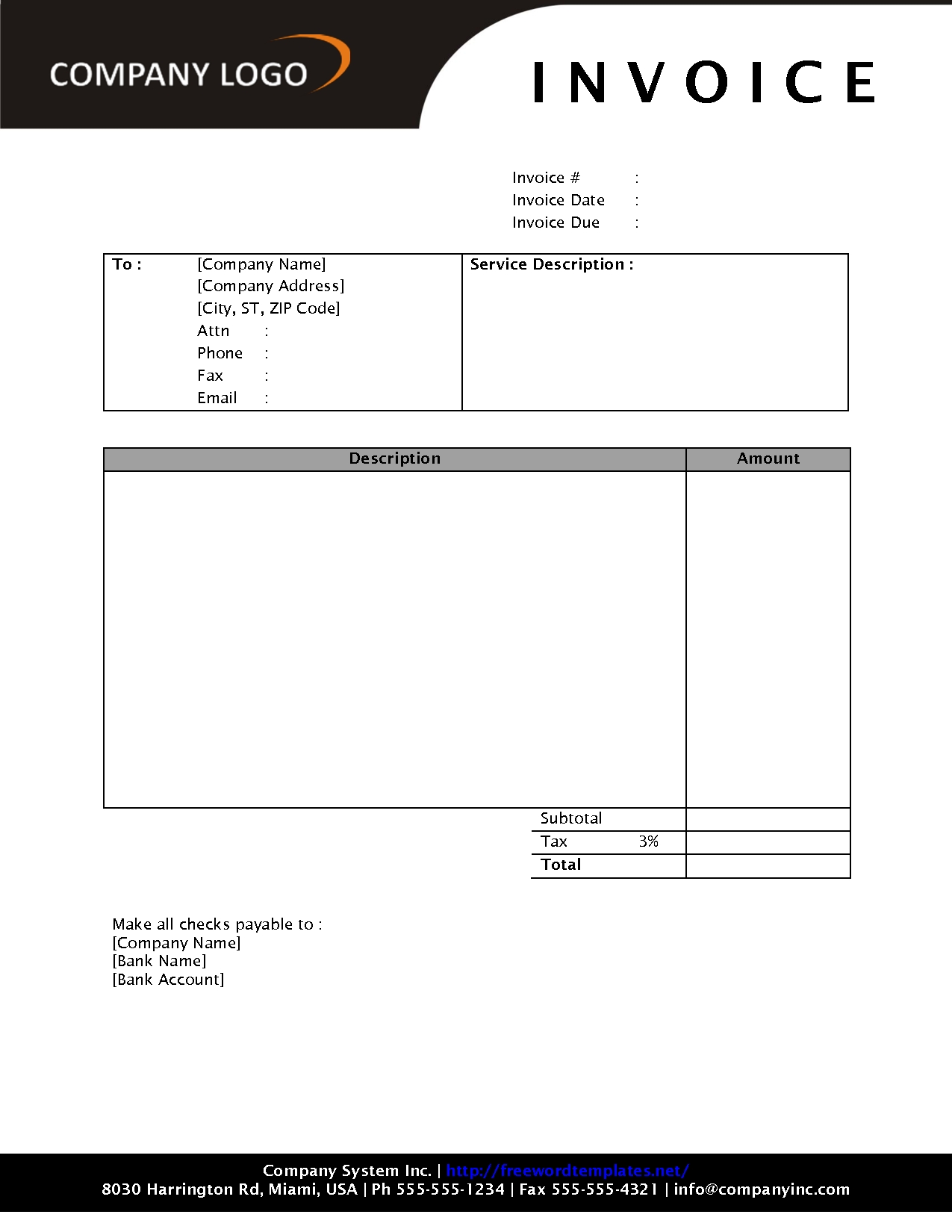

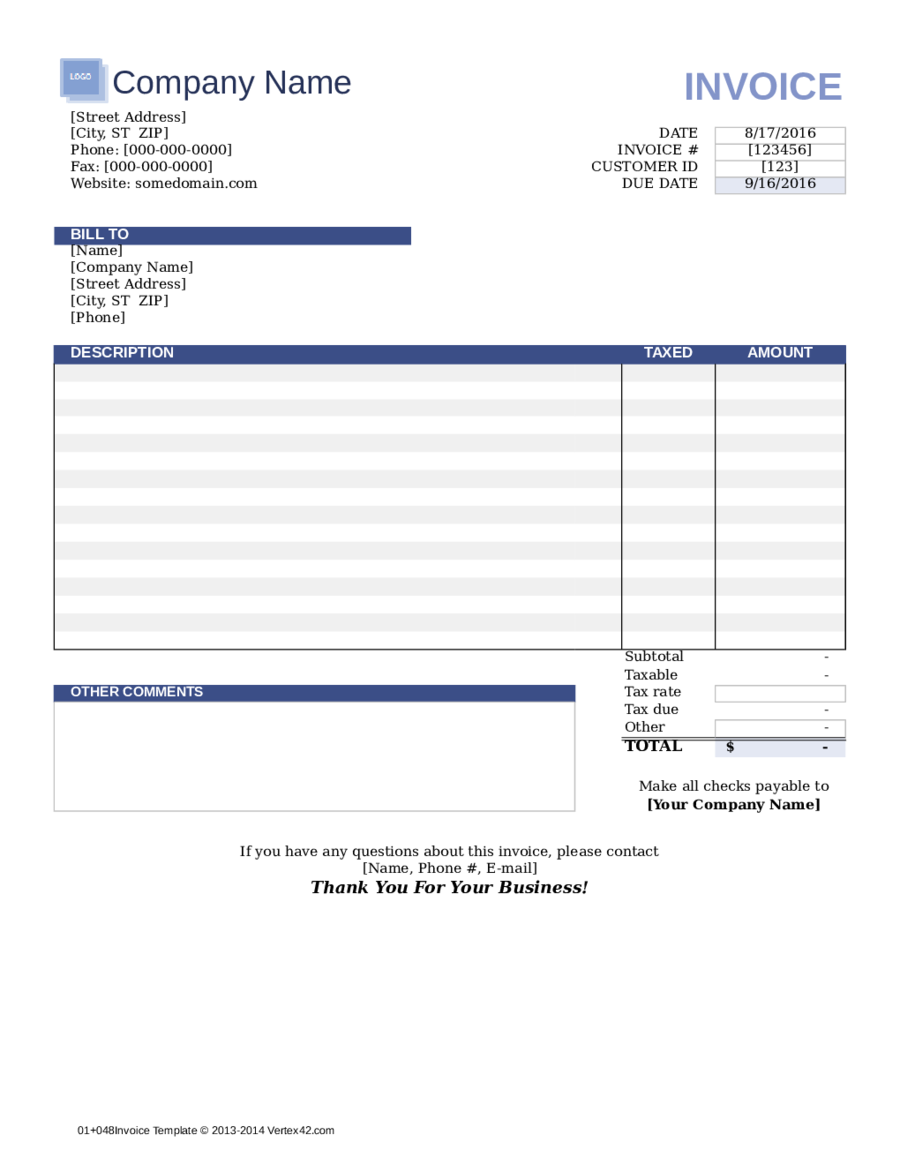

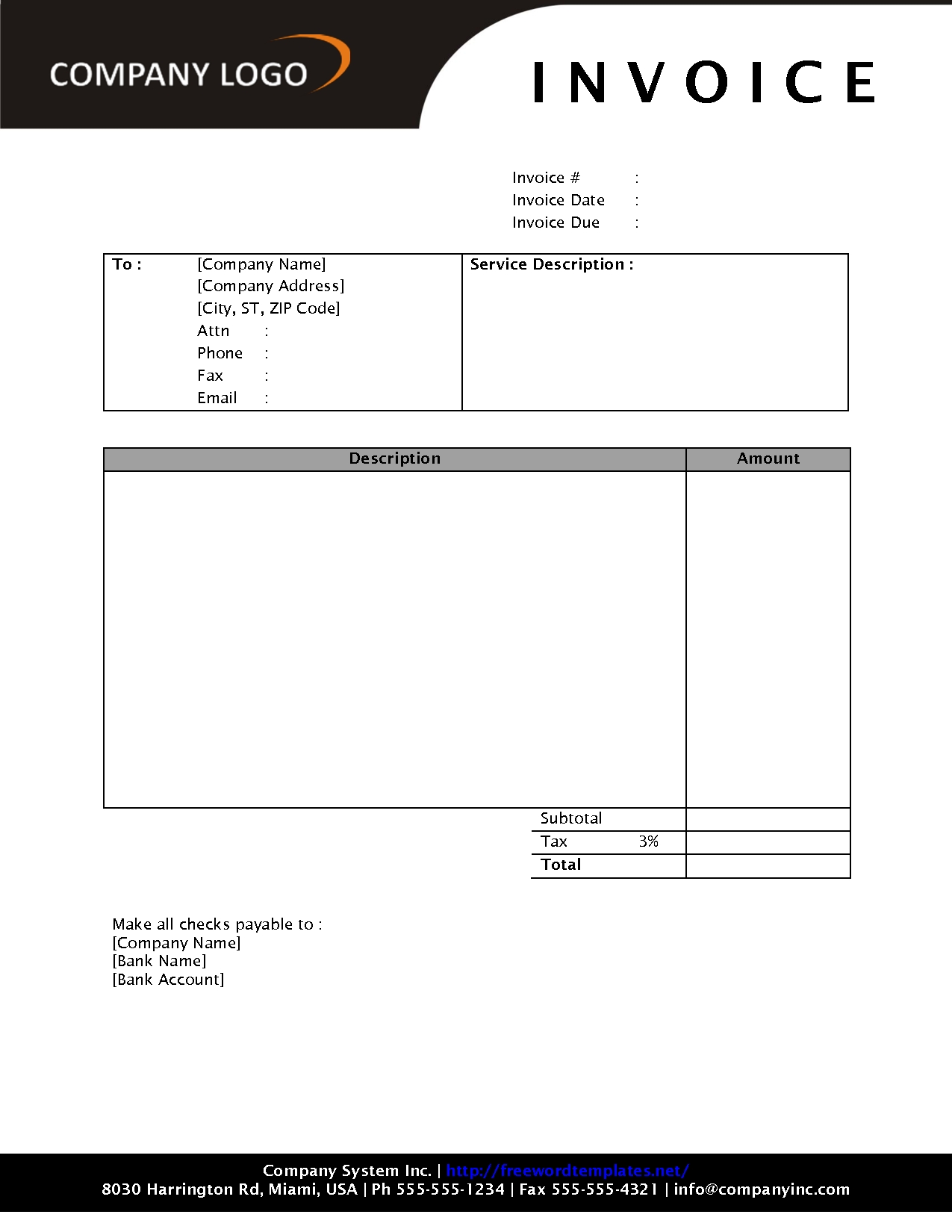

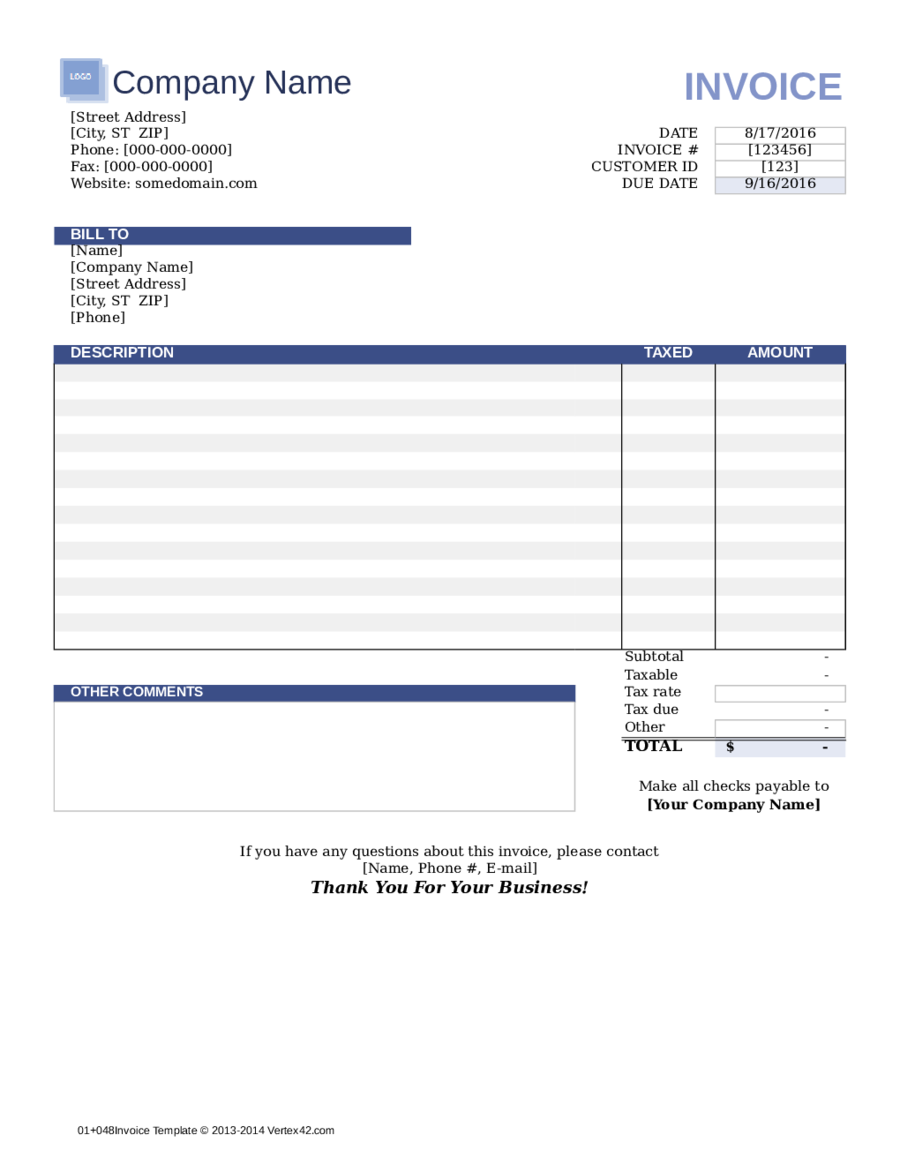

Tax: Indicating the tax rate applied to the cost of the goods or services provided is legally required on invoices. The line items also require a quantity so the customer knows how many goods or services they are being billed for, the price of the line item and tax rate applied to it, and the amount the line item costs. Line Item: Each line item on an invoice should have a name for the goods or services provided, along with a description of those goods and services. And, since invoices are often due in a specified number of days after receival, the invoice date is important in showcasing when payment is due. Invoice Date: The invoice date indicates when an invoice has been issued which helps your customers if they are receiving multiple invoices from you. Invoice numbers can be formatted in different ways such as file numbers, billing codes or date-based purchase order numbers. Invoice Number: Every invoice has a unique identifier in the form of an invoice number, which helps you keep track of multiple invoices. Bill to: Your customer's business name and address will be displayed within this section, as it indicates who is being invoiced for the receival of goods or services. Your Company Name & Address: The name and address of your company is usually displayed at the top of your invoice in order to differentiate between the company that is providing the goods and services and the company that is receiving them. Description: A description aides in helping your customer understand the nature of the goods and services being invoiced for. This is helpful for when tax time rolls around and for keeping accurate records of your invoices. Title: A title is a critical element of an invoice because it allows you, and your client, to differentiate between invoices. Here is a list of our partners who offer products that we have affiliate links for.There are 10 elements of an invoice that you should be aware of, some of which are necessary while others can be used for customization. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Second, we also include links to advertisers’ offers in some of our articles these “affiliate links” may generate income for our site when you click on them. This site does not include all companies or products available within the market. The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. First, we provide paid placements to advertisers to present their offers. This compensation comes from two main sources.

Tax: Indicating the tax rate applied to the cost of the goods or services provided is legally required on invoices. The line items also require a quantity so the customer knows how many goods or services they are being billed for, the price of the line item and tax rate applied to it, and the amount the line item costs. Line Item: Each line item on an invoice should have a name for the goods or services provided, along with a description of those goods and services. And, since invoices are often due in a specified number of days after receival, the invoice date is important in showcasing when payment is due. Invoice Date: The invoice date indicates when an invoice has been issued which helps your customers if they are receiving multiple invoices from you. Invoice numbers can be formatted in different ways such as file numbers, billing codes or date-based purchase order numbers. Invoice Number: Every invoice has a unique identifier in the form of an invoice number, which helps you keep track of multiple invoices. Bill to: Your customer's business name and address will be displayed within this section, as it indicates who is being invoiced for the receival of goods or services. Your Company Name & Address: The name and address of your company is usually displayed at the top of your invoice in order to differentiate between the company that is providing the goods and services and the company that is receiving them. Description: A description aides in helping your customer understand the nature of the goods and services being invoiced for. This is helpful for when tax time rolls around and for keeping accurate records of your invoices. Title: A title is a critical element of an invoice because it allows you, and your client, to differentiate between invoices. Here is a list of our partners who offer products that we have affiliate links for.There are 10 elements of an invoice that you should be aware of, some of which are necessary while others can be used for customization. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Second, we also include links to advertisers’ offers in some of our articles these “affiliate links” may generate income for our site when you click on them. This site does not include all companies or products available within the market. The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. First, we provide paid placements to advertisers to present their offers. This compensation comes from two main sources. #Make invoices online for free

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. The Forbes Advisor editorial team is independent and objective.

Next, select invoices and click the “remind” option. To do this, go to “manage invoices” from your account dashboard and select the “unpaid” tab. This will automatically send your customers an email at certain times to remind them of their upcoming payment due date. To help ensure your invoice gets paid, PayPal enables you to set up payment reminders. It’s totally up to you when you want to get paid. You can also give a specific date or no due date at all. By default, the due date of the invoice is “On receipt” but you can choose to be paid within 10, 15, 30, 45, 60 or 90 days. Date of services rendered: Include the date on which you sold products or rendered services.In case of a future date, the invoice is saved and scheduled to be sent on the selected date. The invoice date defaults to the date when you are creating the invoice but you can use a backdate or a future date. Include the following two dates on your invoice:

PayPal gives a default number to your invoice but it is advisable to use a customized invoice number that you can use for filing purposes.

0 kommentar(er)

0 kommentar(er)